Whether it’s a minor bump or a more serious collision, it’s crucial to know how to handle the aftermath effectively—especially when it comes to making an insurance claim. In the UK, the process of filing a car insurance claim involves several steps, from collecting evidence at the scene to working with your insurer. This article outlines everything you need to know about making a car insurance claim after an accident in the UK.

- Immediate Steps After the Accident

a. Ensure Safety

The first priority after any accident is safety. If anyone is hurt, call emergency services immediately by dialling 999.

b. Stop and Stay

According to UK law, you must stop if you’re involved in a car accident. Remain at the scene long enough to provide your information and exchange details with other parties involved.

c. Turn Off the Engine and Turn on Hazard Lights

Turn off your engine to reduce the risk of fire, and switch on your hazard warning lights to alert other drivers.

- Exchange Details with the Other Parties

You should also collect the following details:

Name and contact details of all drivers involved

Vehicle registration numbers

Insurance company names and policy numbers

Details of any passengers or witnesses

Photographic evidence of the damage and scene

If the other party refuses to provide their details or seems uninsured, report the incident to the police.

- Gather Evidence at the Scene

Evidence can significantly support your insurance claim. If it’s safe to do so:

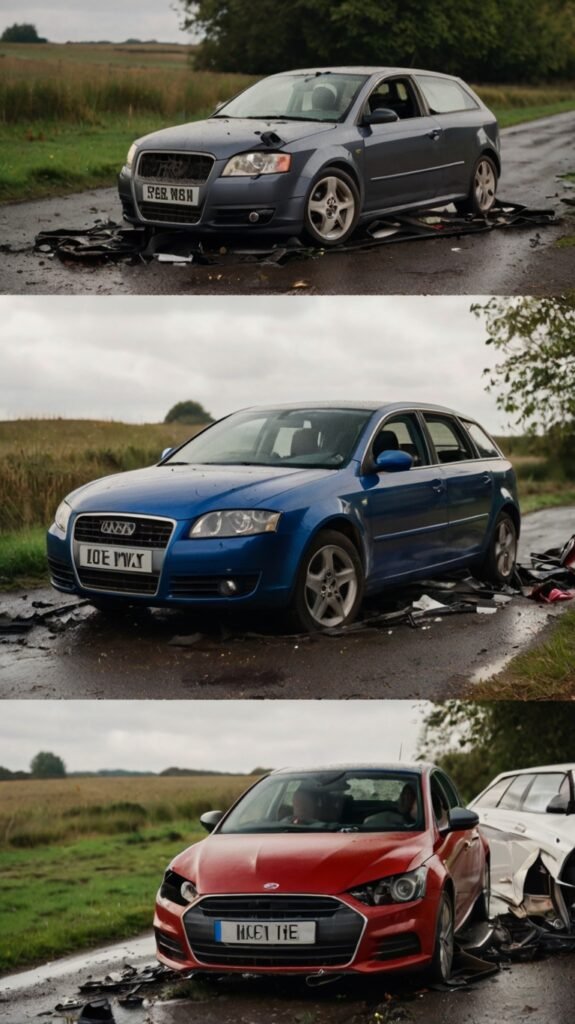

Take photos: Capture images of the damage to all vehicles, the surrounding area, road conditions, and any relevant road signs or markings.

Record details: Note down the time, date, and location of the accident.

Sketch the scene: If you can, make a quick diagram of how the accident happened.

Witness information: Get names and contact details of any witnesses who saw what happened.

Someone is injured.

You suspect the other driver is under the influence of drugs or alcohol.

You can report the accident at your local police station or by calling the non-emergency number 101.

- Notify Your Insurance Company

Even if you don’t intend to make a claim or if the accident wasn’t your fault, you must still inform your insurer as soon as possible—ideally within 24 hours. Be honest and provide all relevant information, including:

Time and location of the accident

Names and details of all parties involved

A brief description of how the accident happened

Police reference number (if applicable)

Photos and other supporting evidence

- Deciding Whether to Claim

a. When to Claim on Your Insurance

You should make a claim if:

You caused the accident (fault claim)

Your car is damaged and needs repair

The other driver is uninsured or refuses to pay

You suffered an injury that requires compensation

b. When You Might Not Want to Claim

You might decide against making a claim if:

The damage is minor and cheaper to repair privately

Claiming could affect your no-claims bonus

The other party is clearly at fault and will cover all costs

Before deciding, consider the cost of repairs vs. the potential impact on your premiums.

- The Claims Process

Once you’ve decided to make a claim, the process generally follows these steps:

a. Contact Your Insurer

You can usually contact your insurance company via phone, email, or through their website or mobile app.

b. Provide All Necessary Information

The insurer will ask for:

Your policy number

Details of the accident

Contact information of involved parties

Police reference (if applicable)

Photos and witness statements

c. Arrange for an Assessment

Your insurer may send an assessor to inspect the damage to your vehicle or ask you to take it to an approved repair centre.

d. Repairs and Courtesy Cars

If you have comprehensive cover, the insurer will arrange repairs at an approved garage. You may be offered a courtesy car while your vehicle is being repaired.

e. Paying the Excess

You’ll usually need to pay your policy excess—this is the amount you agreed to contribute towards any claim. The insurer pays the remaining balance.

- Dealing with Fault and Non-Fault Claims

a. Fault Claim

A fault claim is where you are considered responsible for the accident, or if the insurer cannot recover costs from the other party. Even if it wasn’t technically your fault, if no one else is identified or if the third party isn’t insured, you may still be liable. - Disputes and Rejections

If your claim is rejected, your insurer must provide a reason. Common reasons include:

Insufficient evidence

Policy exclusions

Delayed reporting

If you’re unsatisfied with the response, escalate the matter to the Financial Ombudsman Service (FOS), which resolves disputes between consumers and financial in the UK.

- Tips to Ensure a Smooth Claim

Read your policy thoroughly: Understand what’s covered and what isn’t.

Keep calm and be honest: Accuracy is vital for your claim.

Ask questions: Don’t hesitate to seek clarification from your insurer.

- Conclusion

Navigating a car insurance claim in the UK may seem daunting, but being informed makes the process significantly easier. Reporting promptly, collecting solid evidence, understanding your rights and obligations, and communicating effectively with your insurer are key to a successful outcome.